His career spans leadership roles as CEO of public and private companies, investment funds, and holding groups across Europe and Latin America, with deep expertise in corporate governance, multi-segment portfolio management, mergers and acquisitions, and ESG strategies.

Andreas currently serves as Chairman of the Board at Masisa (Chile), a leading wood products and construction materials company in Latin America, and at Magdalena (Guatemala), an agro-industrial group operating in sugar and renewable energy (biomass and solar). He is also a board member at Copeval (Chile) and Itaú Panamá.

His board experience spans key sectors such as energy, sustainability, real estate, agribusiness, and finance, having served on the boards of VIVA Trust (Switzerland), SUR Funds (Panama), Solarcentury (UK), Younicos (USA and Germany), Ecogeo (Brazil), among others.

He has played a key role in designing and implementing modern corporate governance frameworks, participating in governance, investment, strategy, audit, risk, nomination, and compensation committees.

In his executive career, Andreas was CEO of Grupo Ecos (Panama), a private investment group with a presence in Europe and the Americas focusing on renewable energy and sustainable forestry; and CEO of Amanco Agricultural Solutions in Brazil and Amanco Pipe Systems in Central America, leading operations in irrigation systems and construction materials. Previously, he held senior executive roles in Europe, the USA and Latin America.

Committed to Latin America’s development, Andreas is Chairman of Fundes Internacional, an organization dedicated to the competitiveness of MSMEs in the region. He also serves as a board advisor to INCAE Business School, was founding Chairman of the Swiss-Panamanian Chamber of Commerce (CCSP) and has been a member of the World Business Council for Sustainable Development (WBCSD) and the Advisory Board of PIIC, an impact investment platform in Central America.

His global vision, strong international network, multi-industry experience, and ability to connect investors with strategic opportunities position him as a key leader in transforming companies and markets across Latin America and Europe.

Andreas Eggenberg

Board Chair

Independent Member

Eivind has built a distinguished career at DNB, the largest financial services group in Norway, where he has held multiple leadership roles. He currently serves as Global Head of Project Finance, overseeing a global team and an international portfolio of large-scale PF transactions within energy and infrastructure. He has been instrumental in building the PF organization and business of DNB, which includes a significant footprint in Latin America. He is also part of the management of the Energy Division of DNB, setting strategic directions for its global energy business.

His expertise spans banking and finance, structured and project finance, risk analysis and due diligence, banking regulations, and the global energy sector, with a strong emphasis on renewable energy and sustainable investment. He has worked extensively with alternative sources of risk capacity like multilateral banks, export credit agencies, credit insurance and private debt.

Eivind holds a MSc in Industrial Engineering and Management from NTNU (Norway) and an MBA in International Business from MIIS (US). He is recognized for his ability to build strategic bridges between stakeholders and foster long-term relationships in the investment world. His experience and expertise make him a trusted advisor and a valuable board member for CIFI.

Eivind Hildre

Independent Member

Her career has been distinguished by a strategic approach, expertise in innovation and sustainability, and active participation on the boards of various industries, including finance, capital markets, and international organizations. She is currently a founding partner of 3V Capital Gestão de Recursos, a Multi-Family Office specializing in Wealth Management.

Luciane has held numerous board positions, including on the BSM Market Supervision Council of the B3 group, the Brazilian Financial and Capital Markets Association (ANBIMA), and the Investment Committee of the United Nations Staff Pension Fund, where she represented Latin American countries. She has also played key roles in sustainability and diversity initiatives, such as Climate Finance Hub Brazil and has served as a mentor in programs by the Brazilian Institute of Corporate Governance (IBGC) and Women Corporate Directors (WCD).

One of the most significant milestones in her career was her eight-year tenure as Executive Director of Asset Management at Banco Santander in Brazil, where she managed USD55 billion in assets under management (AUM), led a team of 120 people, and reported directly to the global CEO of Santander Asset Management in London. Previously, she was CEO of Asset Management for Latin America at ABN AMRO Group, managing USD 23 billion in AUM and leading a team of 70 people.

Her time at Banco Safra marked a pivotal point in her career, where she led Asset Management operations in Brazil for four years, growing AUM from USD 9 billion to USD 15 billion and earning recognition for her management. She was also responsible for three years for the bank’s global proprietary investment portfolio and the onshore and offshore portfolios of the group’s main shareholders.

In addition to her success in private banking and investment management, Luciane has been a key figure in financial market regulation and oversight in Brazil, actively participating in governance and sustainability initiatives at the institutional level. Her experience and extensive network have positioned her as one of the most influential leaders in the Wealth Management and Asset Management sectors in Brazil.

Luciane Ribeiro

Independent Member

He currently serves on the boards and investment committees of globally recognized companies, including Cox ABG Group, Altor Capital en Infraestructura, and Beel Infrastructure Partners, where he contributes his expertise in financial structuring and business development in the energy and infrastructure sectors. Luis has also served as an Independent Board Member on the Investment Committee of INFONAVIT in Mexico, bringing his institutional investment and asset management experience to the public sector.

In addition, he is a partner at two internationally active firms: Exus Renewables, an asset management company specializing in renewable energy with a global portfolio of over 150 renewable energy plants, and Genux Power, a joint venture with Glencore focused on energy infrastructure development and financing. His ability to identify investment opportunities, manage asset portfolios, and build strategic partnerships has positioned him as a key player in the global infrastructure sector.

During his career, he held senior positions at Macquarie Group, where he led asset acquisitions for the Macquarie Mexican Infrastructure Fund and oversaw Mergers and Acquisitions (M&A) and capital raising transactions for Macquarie Capital in Latin America, facilitating the Australian multinational’s expansion in the region. Earlier, he held strategic roles in investment banking at Citi Banamex and Deutsche Bank in Mexico and New York, specializing in M&A, financial structuring, and project finance.

With a career marked by innovation in infrastructure and energy financing, Luis has built a strong network across Latin America, positioning himself as a trusted advisor to investors and companies seeking to expand in the region.

Luis Arizaga

Independent Member

For the past nine years, Patricia has served as an independent member on multiple boards across a range of sectors, including energy (nuclear, solar, natural gas, hydro, and wind), as well as mining, retail, insurance, real estate, pulp and paper, petrochemical, and hospitality, in several publicly traded companies.

She currently serves as an independent member of the Audit, Risk, and Compliance Committees of Eletronuclear, the state-owned Brazilian company responsible for operating and managing nuclear power plants, and Origo Energia, a national pioneer and leader in shared distribution of solar energy. She also serves as independent Board Member of Arcel Group, a family-owned Brazilian company operating in the hospitality sector under the prestigious Royal Palm brand. In the past, she has served on the boards of CEMIG, Vale, Naturgy, Light, FGCoop, among others.

At the executive level, Patricia has made a significant impact on the financial industry, particularly in capital markets and structured finance for SMEs. She founded and led Hampton Solfise, a pioneering investment banking boutique specializing in the structuring and execution of Debt Capital Markets transactions, working with the World Bank, Banco Volvo, Bladex, Unibanco/Itaú, and other high-profile clients. Her expertise in structuring FIDCs (Receivables Investment Funds) has been pivotal to the evolution of Brazil’s securitization market, including pioneering securitization transactions backed by consumer loans, trade receivables, and future flows.

An important milestone in Patricia’s career was her tenure with CITIBANK, where she held key positions in both New York and Brazil. These included Director of Global Securitization at the Structured Finance Division, Vice President of LATAM Information Center at the Risk Management Division, and Vice President of the Private Equity Unit at the Investment Banking Division.

Patricia began her professional career in auditing at PricewaterhouseCoopers (PwC) and, later, The Gillette Company. Her extensive regional network, deep expertise in capital markets, and strong background in risk management and infrastructure finance, position her as a strategic advisor of high value to companies and investment funds operating in the region.

She holds a degree in Business Management from the Federal University of Rio de Janeiro (UFRJ) and a master’s in finance (stricto sensu) from the Federal University of São Paulo (USP). Patricia also passed the NASD Series 7 and 63 exams in the United States and was a CVM-registered Independent Investment Agent in Brazil during her executive career.

Patricia Bentes

Independent Member

Audit

Committee

For the past nine years, Patricia has served as an independent member on multiple boards across a range of sectors, including energy (nuclear, solar, natural gas, hydro, and wind), as well as mining, retail, insurance, real estate, pulp and paper, petrochemical, and hospitality, in several publicly traded companies.

She currently serves as an independent member of the Audit, Risk, and Compliance Committees of Eletronuclear, the state-owned Brazilian company responsible for operating and managing nuclear power plants, and Origo Energia, a national pioneer and leader in shared distribution of solar energy. She also serves as independent Board Member of Arcel Group, a family-owned Brazilian company operating in the hospitality sector under the prestigious Royal Palm brand. In the past, she has served on the boards of CEMIG, Vale, Naturgy, Light, FGCoop, among others.

At the executive level, Patricia has made a significant impact on the financial industry, particularly in capital markets and structured finance for SMEs. She founded and led Hampton Solfise, a pioneering investment banking boutique specializing in the structuring and execution of Debt Capital Markets transactions, working with the World Bank, Banco Volvo, Bladex, Unibanco/Itaú, and other high-profile clients. Her expertise in structuring FIDCs (Receivables Investment Funds) has been pivotal to the evolution of Brazil’s securitization market, including pioneering securitization transactions backed by consumer loans, trade receivables, and future flows.

An important milestone in Patricia’s career was her tenure with CITIBANK, where she held key positions in both New York and Brazil. These included Director of Global Securitization at the Structured Finance Division, Vice President of LATAM Information Center at the Risk Management Division, and Vice President of the Private Equity Unit at the Investment Banking Division.

Patricia began her professional career in auditing at PricewaterhouseCoopers (PwC) and, later, The Gillette Company. Her extensive regional network, deep expertise in capital markets, and strong background in risk management and infrastructure finance, position her as a strategic advisor of high value to companies and investment funds operating in the region.

She holds a degree in Business Management from the Federal University of Rio de Janeiro (UFRJ) and a master’s in finance (stricto sensu) from the Federal University of São Paulo (USP). Patricia also passed the NASD Series 7 and 63 exams in the United States and was a CVM-registered Independent Investment Agent in Brazil during her executive career.

Patricia Bentes

Audit Committee Chair

His career spans leadership roles as CEO of public and private companies, investment funds, and holding groups across Europe and Latin America, with deep expertise in corporate governance, multi-segment portfolio management, mergers and acquisitions, and ESG strategies.

Andreas currently serves as Chairman of the Board at Masisa (Chile), a leading wood products and construction materials company in Latin America, and at Magdalena (Guatemala), an agro-industrial group operating in sugar and renewable energy (biomass and solar). He is also a board member at Copeval (Chile) and Itaú Panamá.

His board experience spans key sectors such as energy, sustainability, real estate, agribusiness, and finance, having served on the boards of VIVA Trust (Switzerland), SUR Funds (Panama), Solarcentury (UK), Younicos (USA and Germany), Ecogeo (Brazil), among others.

He has played a key role in designing and implementing modern corporate governance frameworks, participating in governance, investment, strategy, audit, risk, nomination, and compensation committees.

In his executive career, Andreas was CEO of Grupo Ecos (Panama), a private investment group with a presence in Europe and the Americas focusing on renewable energy and sustainable forestry; and CEO of Amanco Agricultural Solutions in Brazil and Amanco Pipe Systems in Central America, leading operations in irrigation systems and construction materials. Previously, he held senior executive roles in Europe, the USA and Latin America.

Committed to Latin America’s development, Andreas is Chairman of Fundes Internacional, an organization dedicated to the competitiveness of MSMEs in the region. He also serves as a board advisor to INCAE Business School, was founding Chairman of the Swiss-Panamanian Chamber of Commerce (CCSP) and has been a member of the World Business Council for Sustainable Development (WBCSD) and the Advisory Board of PIIC, an impact investment platform in Central America.

His global vision, strong international network, multi-industry experience, and ability to connect investors with strategic opportunities position him as a key leader in transforming companies and markets across Latin America and Europe.

Andreas Eggenberg

Independent Member

Her career has been distinguished by a strategic approach, expertise in innovation and sustainability, and active participation on the boards of various industries, including finance, capital markets, and international organizations. She is currently a founding partner of 3V Capital Gestão de Recursos, a Multi-Family Office specializing in Wealth Management.

Luciane has held numerous board positions, including on the BSM Market Supervision Council of the B3 group, the Brazilian Financial and Capital Markets Association (ANBIMA), and the Investment Committee of the United Nations Staff Pension Fund, where she represented Latin American countries. She has also played key roles in sustainability and diversity initiatives, such as Climate Finance Hub Brazil and has served as a mentor in programs by the Brazilian Institute of Corporate Governance (IBGC) and Women Corporate Directors (WCD).

One of the most significant milestones in her career was her eight-year tenure as Executive Director of Asset Management at Banco Santander in Brazil, where she managed USD55 billion in assets under management (AUM), led a team of 120 people, and reported directly to the global CEO of Santander Asset Management in London. Previously, she was CEO of Asset Management for Latin America at ABN AMRO Group, managing USD 23 billion in AUM and leading a team of 70 people.

Her time at Banco Safra marked a pivotal point in her career, where she led Asset Management operations in Brazil for four years, growing AUM from USD 9 billion to USD 15 billion and earning recognition for her management. She was also responsible for three years for the bank’s global proprietary investment portfolio and the onshore and offshore portfolios of the group’s main shareholders.

In addition to her success in private banking and investment management, Luciane has been a key figure in financial market regulation and oversight in Brazil, actively participating in governance and sustainability initiatives at the institutional level. Her experience and extensive network have positioned her as one of the most influential leaders in the Wealth Management and Asset Management sectors in Brazil.

Luciane Ribeiro

Independent Member

Compensation

Committee

Her career has been distinguished by a strategic approach, expertise in innovation and sustainability, and active participation on the boards of various industries, including finance, capital markets, and international organizations. She is currently a founding partner of 3V Capital Gestão de Recursos, a Multi-Family Office specializing in Wealth Management.

Luciane has held numerous board positions, including on the BSM Market Supervision Council of the B3 group, the Brazilian Financial and Capital Markets Association (ANBIMA), and the Investment Committee of the United Nations Staff Pension Fund, where she represented Latin American countries. She has also played key roles in sustainability and diversity initiatives, such as Climate Finance Hub Brazil and has served as a mentor in programs by the Brazilian Institute of Corporate Governance (IBGC) and Women Corporate Directors (WCD).

One of the most significant milestones in her career was her eight-year tenure as Executive Director of Asset Management at Banco Santander in Brazil, where she managed USD55 billion in assets under management (AUM), led a team of 120 people, and reported directly to the global CEO of Santander Asset Management in London. Previously, she was CEO of Asset Management for Latin America at ABN AMRO Group, managing USD 23 billion in AUM and leading a team of 70 people.

Her time at Banco Safra marked a pivotal point in her career, where she led Asset Management operations in Brazil for four years, growing AUM from USD 9 billion to USD 15 billion and earning recognition for her management. She was also responsible for three years for the bank’s global proprietary investment portfolio and the onshore and offshore portfolios of the group’s main shareholders.

In addition to her success in private banking and investment management, Luciane has been a key figure in financial market regulation and oversight in Brazil, actively participating in governance and sustainability initiatives at the institutional level. Her experience and extensive network have positioned her as one of the most influential leaders in the Wealth Management and Asset Management sectors in Brazil.

Luciane Ribeiro

Compensation Committee Chair

His career spans leadership roles as CEO of public and private companies, investment funds, and holding groups across Europe and Latin America, with deep expertise in corporate governance, multi-segment portfolio management, mergers and acquisitions, and ESG strategies.

Andreas currently serves as Chairman of the Board at Masisa (Chile), a leading wood products and construction materials company in Latin America, and at Magdalena (Guatemala), an agro-industrial group operating in sugar and renewable energy (biomass and solar). He is also a board member at Copeval (Chile) and Itaú Panamá.

His board experience spans key sectors such as energy, sustainability, real estate, agribusiness, and finance, having served on the boards of VIVA Trust (Switzerland), SUR Funds (Panama), Solarcentury (UK), Younicos (USA and Germany), Ecogeo (Brazil), among others.

He has played a key role in designing and implementing modern corporate governance frameworks, participating in governance, investment, strategy, audit, risk, nomination, and compensation committees.

In his executive career, Andreas was CEO of Grupo Ecos (Panama), a private investment group with a presence in Europe and the Americas focusing on renewable energy and sustainable forestry; and CEO of Amanco Agricultural Solutions in Brazil and Amanco Pipe Systems in Central America, leading operations in irrigation systems and construction materials. Previously, he held senior executive roles in Europe, the USA and Latin America.

Committed to Latin America’s development, Andreas is Chairman of Fundes Internacional, an organization dedicated to the competitiveness of MSMEs in the region. He also serves as a board advisor to INCAE Business School, was founding Chairman of the Swiss-Panamanian Chamber of Commerce (CCSP) and has been a member of the World Business Council for Sustainable Development (WBCSD) and the Advisory Board of PIIC, an impact investment platform in Central America.

His global vision, strong international network, multi-industry experience, and ability to connect investors with strategic opportunities position him as a key leader in transforming companies and markets across Latin America and Europe.

Andreas Eggenberg

Independent Member

He currently serves on the boards and investment committees of globally recognized companies, including Cox ABG Group, Altor Capital en Infraestructura, and Beel Infrastructure Partners, where he contributes his expertise in financial structuring and business development in the energy and infrastructure sectors. Luis has also served as an Independent Board Member on the Investment Committee of INFONAVIT in Mexico, bringing his institutional investment and asset management experience to the public sector.

In addition, he is a partner at two internationally active firms: Exus Renewables, an asset management company specializing in renewable energy with a global portfolio of over 150 renewable energy plants, and Genux Power, a joint venture with Glencore focused on energy infrastructure development and financing. His ability to identify investment opportunities, manage asset portfolios, and build strategic partnerships has positioned him as a key player in the global infrastructure sector.

During his career, he held senior positions at Macquarie Group, where he led asset acquisitions for the Macquarie Mexican Infrastructure Fund and oversaw Mergers and Acquisitions (M&A) and capital raising transactions for Macquarie Capital in Latin America, facilitating the Australian multinational’s expansion in the region. Earlier, he held strategic roles in investment banking at Citi Banamex and Deutsche Bank in Mexico and New York, specializing in M&A, financial structuring, and project finance.

With a career marked by innovation in infrastructure and energy financing, Luis has built a strong network across Latin America, positioning himself as a trusted advisor to investors and companies seeking to expand in the region.

Luis Arizaga

Independent Member

Credit

Committee

Since taking the helm as CEO in 2015, César has driven CIFI’s strategic growth, relocating its headquarters to Panama and expanding its services to include asset management. Under his leadership, the institution has diversified its funding sources, becoming a bond issuer in multiple Latin American countries and launching innovative products such as the first local-currency fund in the Dominican Republic (USD 250 million) and a USD 100 million securitization program in El Salvador.

Prior to his role as CEO, César held several leadership positions within CIFI, including Transaction Manager and Business Development Manager. Before joining CIFI, he held executive roles at Prointec, where he managed international business development in emerging markets, and at Ernst & Young as an auditor, gaining significant expertise in corporate finance and project consultancy across various industries.

César Cañedo-Argüelles holds a Bachelor’s degree in Business Administration and Finance from Saint Louis University (Missouri, USA). He also earned a Master’s degree in Finance from IE Business School and a Master’s in Business Administration from the Centro de Estudios Financieros, both located in Madrid, Spain.

César Cañedo-Argüelles

CEO and Credit Committee Chair

She is currently the Head of M&A Renewables for Spain’s Cepsa and is supporting the company in its energy transition. Prior to that she was a Senior Advisor for Sonnedix, a global solar power producer and she also served as Managing Director and for the financial advisory firm Rubicon Capital Advisors.

Previous functions include Managing Director and Head of Infrastructure Investments in Latin America for the Caisse de dépôt et placement du Québec (CDPQ) in Montreal. Under such role, she was responsible for defining the investment strategy and the deployment of capital in infrastructure in Latin America for Canada’s second largest pension fund manager.

She also served under different roles at the Inter-American Development Bank (IDB) and at CAF Latin American Development Bank, where she led the origination and structuring of infrastructure project financings across Latin America.

Ms. Vidaurre is a multicultural professional, with residences and education in Venezuela, France, the U.S., Canada and Spain. She is fluent in Spanish, English, French, and proficient in Portuguese. She has several boards, including Mexico’s Conmex road and Kino renewable energy holdings in Mexico.

Ana Maria holds a Bachelor’s of Business Administration from Universidad Metropolitana in Caracas, Venezuela, and an MBA from ESSEC Business School in Paris, France.

Ana Maria Vidaurre

Independent Member

He is a member of the Pipeline, ALCO and Credit Committees, and secretary of the CIFI Risk Committee.

Fabio is a decisive, action-oriented and results-driven senior executive with over 25 years of experience in multi-diverse environments, including banking, infrastructure, energy and manufacturing industries.

He is a team leader with a proven ability to effectively achieve objectives through sound management, effective leadership and analytical skills, with proven success in mitigating risks in companies with leverage issues in Latin America.

He holds a PhD in Statistics and a Master's degree in Operations Research and Infrastructure Management from Rensselaer Polytechnic Institute, and a Bachelor's degree in Civil Engineering from Universidad de los Andes (Colombia).

He is certified as a Financial Risk Manager (FRM) by the Global Association of Risk Professionals (GARP), and as a PMP by the Project Management Institute. He was also a member of the Risk Committee at the Panama Banking Association (2012-2015), where the Committee oversaw the analysis, discussion and negotiation of the new Agreement No. 4-2013, which established all regulation related to credit risk management, from origination to credit reserves and credit risk models, following Basel II.

Joined CIFI in 2016 and became a shareholder of Valora in 2019.

Fabio Arciniegas

Chief Operating Officer

He is a member CIFI’s founding team, since 2002 when he joined the company as Legal Advisor. He became General Counsel in 2012, where he is responsible for directing all legal affairs of the company and managing its legal department.

During his tenure at CIFI he has led and overseen the structuring, negotiation, closing and monitoring of more than $1.5 billion worth of assets, all its liabilities in both the syndicated loan and capitals markets, while leading CIFI’s corporate and regulatory matters (including advising on audit, budgeting, compliance, employment, governance, investor presentation, litigation, securities and tax planning matters). Since January 2021, he is a member of its Credit Committee. Prior to joining CIFI, between 1996 and 2001, he was an Associate at Torres, Plaz & Araujo, a well-known corporate and tax law firm in Caracas, Venezuela, where he advised multinational corporations doing business in the country. In 1998 he was seconded as in-house legal counsel to EPIC, Exploración & Producción, Entidad de Inversión Colectiva, an affiliate of PDVSA, to lead its legal department in the initial public offering of shares valued at $450 million in the capital market in Venezuela and New York (then the largest IPO in Venezuela).

He holds a Master of Business Administration (2003) from Kogod School of Business, American University, Washington, DC.; a Master in International Commercial Law (LL.M) (1995) from the George Washington University, School of Law, Washington, DC.; and a Juris Doctor (1992) from Universidad Central de Venezuela, School of Law, Caracas, Venezuela.

Jose Salaverria

General Counsel

Risk

Committee

Eivind has built a distinguished career at DNB, the largest financial services group in Norway, where he has held multiple leadership roles. He currently serves as Global Head of Project Finance, overseeing a global team and an international portfolio of large-scale PF transactions within energy and infrastructure. He has been instrumental in building the PF organization and business of DNB, which includes a significant footprint in Latin America. He is also part of the management of the Energy Division of DNB, setting strategic directions for its global energy business.

His expertise spans banking and finance, structured and project finance, risk analysis and due diligence, banking regulations, and the global energy sector, with a strong emphasis on renewable energy and sustainable investment. He has worked extensively with alternative sources of risk capacity like multilateral banks, export credit agencies, credit insurance and private debt.

Eivind holds a MSc in Industrial Engineering and Management from NTNU (Norway) and an MBA in International Business from MIIS (US). He is recognized for his ability to build strategic bridges between stakeholders and foster long-term relationships in the investment world. His experience and expertise make him a trusted advisor and a valuable board member for CIFI.

Eivind Hildre

Risk Committee Chair

He currently serves on the boards and investment committees of globally recognized companies, including Cox ABG Group, Altor Capital en Infraestructura, and Beel Infrastructure Partners, where he contributes his expertise in financial structuring and business development in the energy and infrastructure sectors. Luis has also served as an Independent Board Member on the Investment Committee of INFONAVIT in Mexico, bringing his institutional investment and asset management experience to the public sector.

In addition, he is a partner at two internationally active firms: Exus Renewables, an asset management company specializing in renewable energy with a global portfolio of over 150 renewable energy plants, and Genux Power, a joint venture with Glencore focused on energy infrastructure development and financing. His ability to identify investment opportunities, manage asset portfolios, and build strategic partnerships has positioned him as a key player in the global infrastructure sector.

During his career, he held senior positions at Macquarie Group, where he led asset acquisitions for the Macquarie Mexican Infrastructure Fund and oversaw Mergers and Acquisitions (M&A) and capital raising transactions for Macquarie Capital in Latin America, facilitating the Australian multinational’s expansion in the region. Earlier, he held strategic roles in investment banking at Citi Banamex and Deutsche Bank in Mexico and New York, specializing in M&A, financial structuring, and project finance.

With a career marked by innovation in infrastructure and energy financing, Luis has built a strong network across Latin America, positioning himself as a trusted advisor to investors and companies seeking to expand in the region.

Luis Arizaga

Independent Member

For the past nine years, Patricia has served as an independent member on multiple boards across a range of sectors, including energy (nuclear, solar, natural gas, hydro, and wind), as well as mining, retail, insurance, real estate, pulp and paper, petrochemical, and hospitality, in several publicly traded companies.

She currently serves as an independent member of the Audit, Risk, and Compliance Committees of Eletronuclear, the state-owned Brazilian company responsible for operating and managing nuclear power plants, and Origo Energia, a national pioneer and leader in shared distribution of solar energy. She also serves as independent Board Member of Arcel Group, a family-owned Brazilian company operating in the hospitality sector under the prestigious Royal Palm brand. In the past, she has served on the boards of CEMIG, Vale, Naturgy, Light, FGCoop, among others.

At the executive level, Patricia has made a significant impact on the financial industry, particularly in capital markets and structured finance for SMEs. She founded and led Hampton Solfise, a pioneering investment banking boutique specializing in the structuring and execution of Debt Capital Markets transactions, working with the World Bank, Banco Volvo, Bladex, Unibanco/Itaú, and other high-profile clients. Her expertise in structuring FIDCs (Receivables Investment Funds) has been pivotal to the evolution of Brazil’s securitization market, including pioneering securitization transactions backed by consumer loans, trade receivables, and future flows.

An important milestone in Patricia’s career was her tenure with CITIBANK, where she held key positions in both New York and Brazil. These included Director of Global Securitization at the Structured Finance Division, Vice President of LATAM Information Center at the Risk Management Division, and Vice President of the Private Equity Unit at the Investment Banking Division.

Patricia began her professional career in auditing at PricewaterhouseCoopers (PwC) and, later, The Gillette Company. Her extensive regional network, deep expertise in capital markets, and strong background in risk management and infrastructure finance, position her as a strategic advisor of high value to companies and investment funds operating in the region.

She holds a degree in Business Management from the Federal University of Rio de Janeiro (UFRJ) and a master’s in finance (stricto sensu) from the Federal University of São Paulo (USP). Patricia also passed the NASD Series 7 and 63 exams in the United States and was a CVM-registered Independent Investment Agent in Brazil during her executive career.

Patricia Bentes

Independent Member

Risk Management

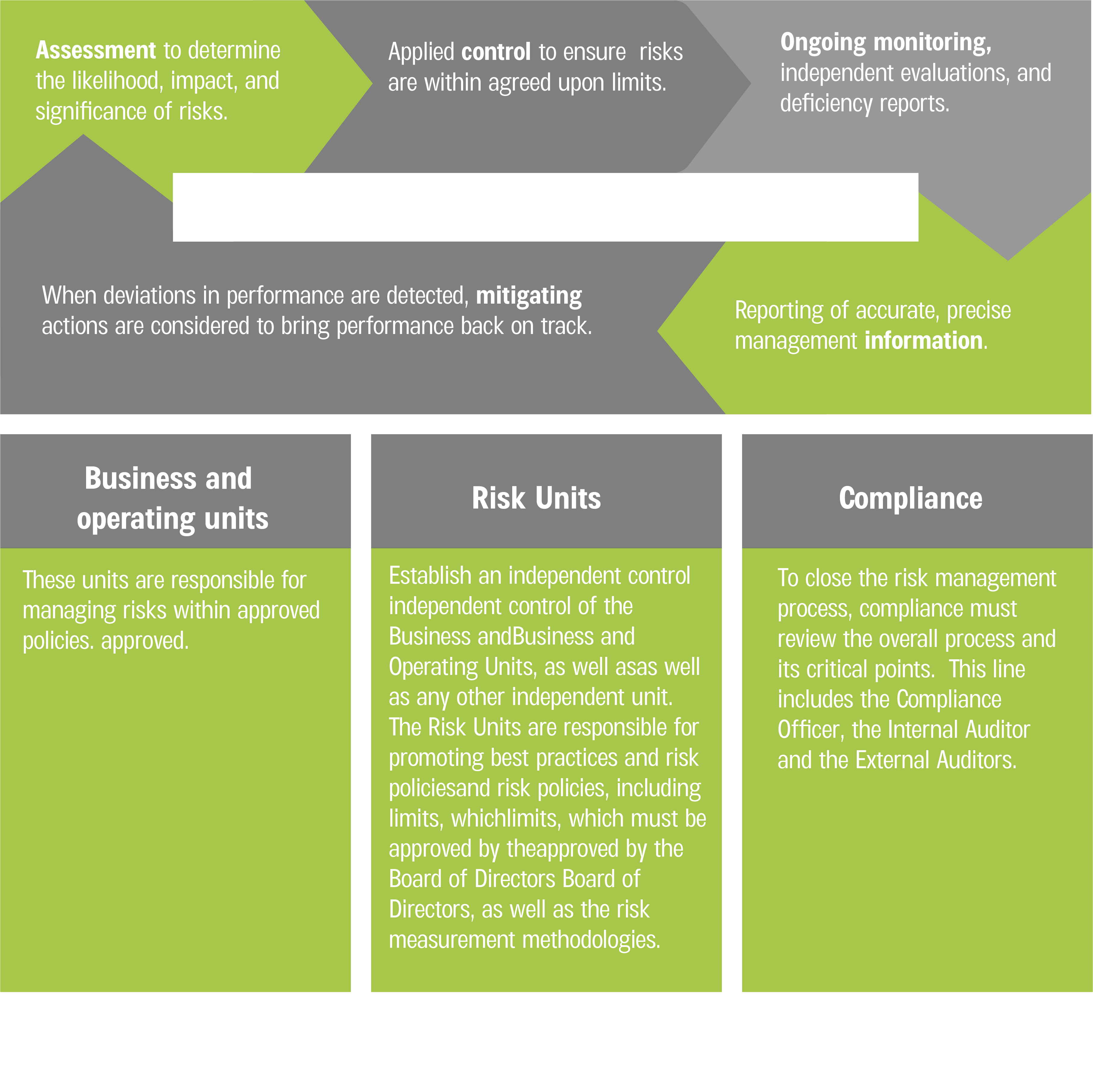

Risk Management Process

The main objective of CIFI´s ERM is to achieve a coherent regulatory framework aligned with our business model that fosters a business risk culture inherent in all areas and influences proactive involvement when facing risks, so all areas may identify, measure, monitor, control, and report all the risks to which they are exposed.

Indentifying is a key component of CIFI’s ERM, which includes early identifying techniques and a well-defined risk appetite and tolerance to identify the risks the company faces.

Risk Management Process

The main objective of CIFI´s ERM is to achieve a coherent regulatory framework aligned with our business model that fosters a business risk culture inherent in all areas and influences proactive involvement when facing risks, so all areas may identify, measure, monitor, control, and report all the risks to which they are exposed.

Indentifying is a key component of CIFI’s ERM, which includes early identifying techniques and a well-defined risk appetite and tolerance to identify the risks the company faces.

Management Team

Since taking the helm as CEO in 2015, César has driven CIFI’s strategic growth, relocating its headquarters to Panama and expanding its services to include asset management. Under his leadership, the institution has diversified its funding sources, becoming a bond issuer in multiple Latin American countries and launching innovative products such as the first local-currency fund in the Dominican Republic (USD 250 million) and a USD 100 million securitization program in El Salvador.

Prior to his role as CEO, César held several leadership positions within CIFI, including Transaction Manager and Business Development Manager. Before joining CIFI, he held executive roles at Prointec, where he managed international business development in emerging markets, and at Ernst & Young as an auditor, gaining significant expertise in corporate finance and project consultancy across various industries.

César Cañedo-Argüelles holds a Bachelor’s degree in Business Administration and Finance from Saint Louis University (Missouri, USA). He also earned a Master’s degree in Finance from IE Business School and a Master’s in Business Administration from the Centro de Estudios Financieros, both located in Madrid, Spain.

César Cañedo-Argüelles

Chief Executive Officer

She has 18 years of experience in scientific research, applied sciences for global problems, sustainable development, clean energy, climate change, green lending, and impact investment. Prior to CIFI, Carla worked extensively in Latin America and the Caribbean with scientific research organizations (Smithsonian), the academia (Yale University), and multilateral organizations (United Nations).

At CIFI, oversees managing E&S risks and impacts prior to investments, supervises ESG performance of the portfolio, compliance with CIFI’s policy framework, stakeholder engagement, identification of green business opportunities and funding, development of tools, and reporting with transparency. Carla is currently developing a Decarbonization Strategy to align CIFI’s investment portfolio to a 1.5°C economy, is responsible for the Gender Equality Strategy of the company, and commitments towards Human Rights in all our investments.

She was part of the team that issued the first Green Bond Programme in Panama for $200MM, designed of an ESG Software, a Key Risk Indicator, and a Scoring System to manage ESG risks. Carla is an Equator Principles Association Steering Committee member, and Lead of the Regional Network for Latin America.

She has strong technical expertise, is results oriented, has great networking skills, creative-analytical thinking, outstanding organizational and communication skills, is proactive, and an excellent researcher with knowledge management. She is fluent in Spanish, English and proficient in Portuguese.

She has been with CIFI since 2016, joined the management team of the company in 2018, and became a shareholder in Valora in 2019.

Carla Chízmar

Head of Environmental, Social, and Governance

He is a member CIFI’s founding team, since 2002 when he joined the company as Legal Advisor. He became General Counsel in 2012, where he is responsible for directing all legal affairs of the company and managing its legal department.

During his tenure at CIFI he has led and overseen the structuring, negotiation, closing and monitoring of more than $1.5 billion worth of assets, all its liabilities in both the syndicated loan and capitals markets, while leading CIFI’s corporate and regulatory matters (including advising on audit, budgeting, compliance, employment, governance, investor presentation, litigation, securities and tax planning matters). Since January 2021, he is a member of its Credit Committee. Prior to joining CIFI, between 1996 and 2001, he was an Associate at Torres, Plaz & Araujo, a well-known corporate and tax law firm in Caracas, Venezuela, where he advised multinational corporations doing business in the country. In 1998 he was seconded as in-house legal counsel to EPIC, Exploración & Producción, Entidad de Inversión Colectiva, an affiliate of PDVSA, to lead its legal department in the initial public offering of shares valued at $450 million in the capital market in Venezuela and New York (then the largest IPO in Venezuela).

He holds a Master of Business Administration (2003) from Kogod School of Business, American University, Washington, DC.; a Master in International Commercial Law (LL.M) (1995) from the George Washington University, School of Law, Washington, DC.; and a Juris Doctor (1992) from Universidad Central de Venezuela, School of Law, Caracas, Venezuela.

Jose Salaverria

General Counsel

He is a member of the Pipeline, ALCO and Credit Committees, and secretary of the CIFI Risk Committee.

Fabio is a decisive, action-oriented and results-driven senior executive with over 25 years of experience in multi-diverse environments, including banking, infrastructure, energy and manufacturing industries.

He is a team leader with a proven ability to effectively achieve objectives through sound management, effective leadership and analytical skills, with proven success in mitigating risks in companies with leverage issues in Latin America.

He holds a PhD in Statistics and a Master's degree in Operations Research and Infrastructure Management from Rensselaer Polytechnic Institute, and a Bachelor's degree in Civil Engineering from Universidad de los Andes (Colombia).

He is certified as a Financial Risk Manager (FRM) by the Global Association of Risk Professionals (GARP), and as a PMP by the Project Management Institute. He was also a member of the Risk Committee at the Panama Banking Association (2012-2015), where the Committee oversaw the analysis, discussion and negotiation of the new Agreement No. 4-2013, which established all regulation related to credit risk management, from origination to credit reserves and credit risk models, following Basel II.

Joined CIFI in 2016 and became a shareholder of Valora in 2019.

Fabio Arciniegas

Chief Operating Officer