CIFI has created a funding platform that focuses on mobilizing financial resources para to promote investments in infrastructure and energy with a focus on environmental sustainability and combating climate change.

CIFI has created a funding platform that focuses on mobilizing financial resources para to promote investments in infrastructure and energy with a focus on environmental sustainability and combating climate change.

¿Why invest in Green bonds?

Green Bond

Program

CIFI’s Green Bond program is in line with the Green Bond Principles created by the International Capital Markets Association (IMCA), and is based on promoting transparency and disclosure of information. CIFI’s green bonds are instruments issued through the Stock Exchange through a program registered with the Superintendency of the Securities Market of Panama, whose funds are intended exclusively to finance eligible green projects in compliance with our Green Bond Framework, which sets out the characteristics that a project must meet to be considered for the use of funds issued under this program.

Green Bond Program

CIFI’s Green Bond program is in line with the Green Bond Principles created by the International Capital Markets Association (IMCA), and is based on promoting transparency and disclosure of information. CIFI’s green bonds are instruments issued through the Stock Exchange through a program registered with the Superintendency of the Securities Market of Panama, whose funds are intended exclusively to finance eligible green projects in compliance with our Green Bond Framework, which sets out the characteristics that a project must meet to be considered for the use of funds issued under this program.

Issuer profile GBTP (greenbondtransparency.com)

CIFI has joined the IDB Invest initiative in its Green Bond Transparency Platform,

if you want to learn more click here

Emissions and use of Funds

IMPACT

INDICATORS

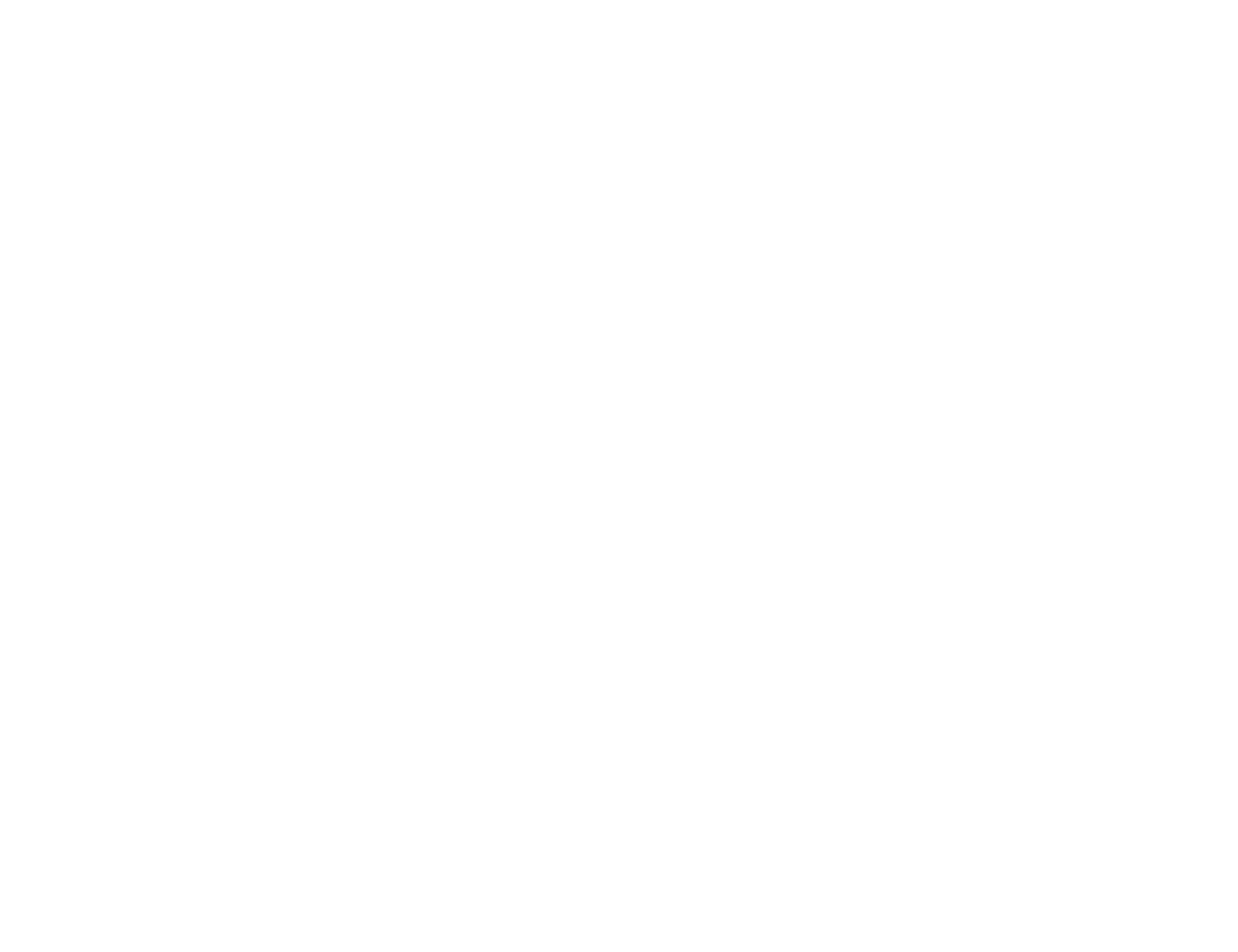

Our Green Bond Program offers investors an opportunity to support projects with a financially and environmentally responsible return, while promoting the advancement of the Sustainable Development Goals.

Visit our impact indicators to learn more about our contributions to the SDGs.

IMPACT INDICATORS

Our Green Bond Program offers investors an opportunity to support projects with a financially and environmentally responsible return, while promoting the advancement of the Sustainable Development Goals.

Visit our impact indicators to learn more about our contributions to the SDGs.

Projects financed

through the

Revolving Green Bond

Installed capacity: 9.26 MW

Project cost: USD15,9 MILLIONS

Financed by CIFI: USD11,5 MILLIONS

Environmental category: B (medio)

Start of operation: 2016

Annual production: 12.8 GW/h

CO2 emissions avoided : 6,659 CO2 tons per year

Structured by: CIFI

Installed capacity: 9.4 MW

Project cost: USD25,5 MILLIONS

Financed by CIFI: USD13 MILLIONS

Environmental category: B (medio)

Start of operation: 2017

Annual production: 42.5 GW/h

CO2 emissions avoided: 20,108 CO2 tons per year

Structured by: Banco Centroamericano de Integración Económica

Installed capacity: 6.78 MW

Project cost: USD 5,9 MILLIONS

Financed by CIFI: USD5,9 MILLIONS

Environmental category: B (medio)

Start of operation: 2017

Annual production: 12.7 GW/h

CO2 emissiones avoided: 3,373 CO2 tons per year

Structured by: CIFI

Installed capacity: 3 MW

Project cost: USD 3,9 MILLIONS

Financed by CIFI: USD 2,24 MILLIONS

Environmental category: B (medio)

Start of operation: 2017

Annual production: 5.6 GW/h

CO2 emissions avoided: 3,012 CO2 tons per year

Structured by: CIFI

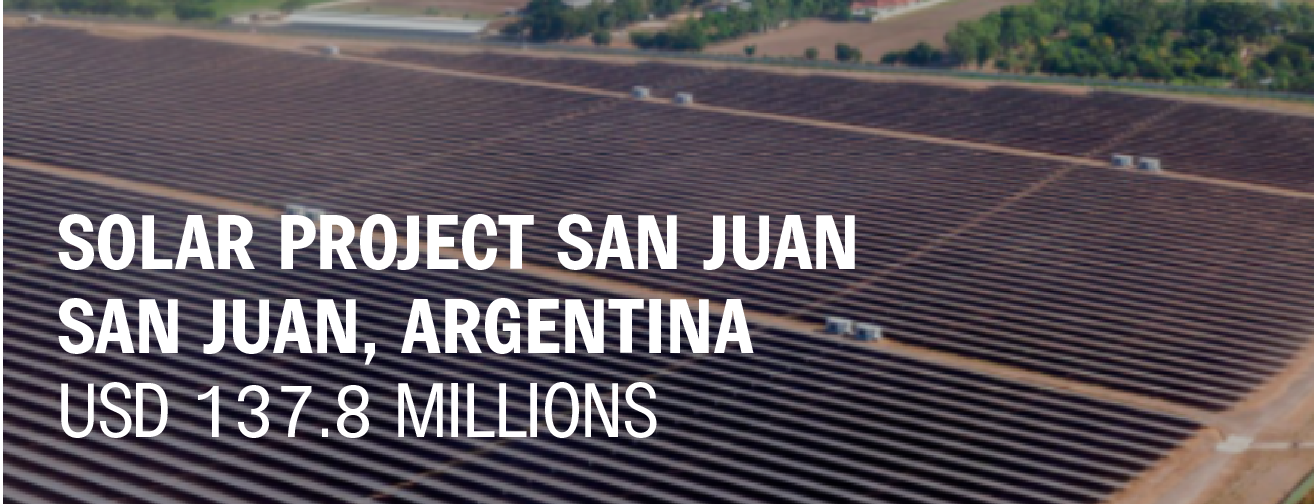

Installed capacity: 80 MW

Project cost: USD 137,8 MILLIONS

Financed by CIFI: USD 13,6 MILLIONS

Environmental category: B (medio)

Start of operation: 2019

Annual production: 222.7 GW/h

CO2 emissions avoided: 110,687 CO2 tons per year

Structured by: IDB Invest

Installed capacity: 29.952 MW

Project cost: USD 15,5 MILLIONS

Financed by CIFI: USD 10 MILLIONS

Environmental category: B (medio)

Start of operation: 2018

Annual production: 14.3 GW/h

CO2 emissions avoided: 7,879 CO2 tons per year

Structured by: CIFI

Installed capacity: 100 MW

Project cost: USD 158,28 MILLIONS

Financed by CIFI: USD 15 MILLIONS

Environmental category: B (medio)

Start of operation: 2017

Annual production: 225.2 GW/h

CO2 emissions avoided: 154,252 CO2 tons per year

Structured by: Banco Centroamericano de Integración Económica