How we direct, administer, and regulate our work at CIFI reveals who we are and what we stand for. We have developed processes and policies to meet our obligations and reflect our mission.

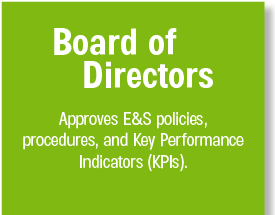

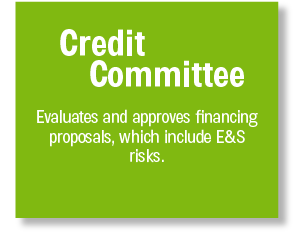

CIFI’s Board of Directors actively oversees the portfolio’s performance concerning environmental and social risks through its Credit and Risk Committees. Also, each of the key senior management units has an important role in the identification, assessment, and management of E&S risks in the project cycle. The ESG Unit plays a central role in ensuring the effective implementation of our environmental and social policies and procedures.