Judith holds an M.B.A. from Harvard Business School and a B.A. in Economics from Wellesley College. Fluent in English, Spanish, Portuguese, French, and Hungarian, she is a dual Venezuelan/Hungarian national. She is also on the Board of Directors of Agua Imara; a Norwegian renewable energy company focused on hydropower in Africa and Central America.

Judith de Barany

Board Chair

Independent Member

Eivind Hildre

Independent Member

Throughout her career, Helena has held different roles at the Finnish Fund for Industrial Cooperation (Finnfund), a Finnish development financier and impact investor, where she is currently Associate Director and Senior Investment Manager of the power team.

Helena has been part of boards and investment committees for the last 20 years. She has made significant contributions to renewable energy projects worldwide, including in Africa, Asia or Central America. She is currently a Board Member at Fortum Charge & Drive India Pvt Ltd and Lake Turkana Wind Power Ltd. (Kenya). She also sits on the Investment Committees of ElectriFi and Interact Climate Change Facility, both part of the European Development Finance Institutions.

Helena Teppana

FINNFUND

During this tenure Javier has been member in over 40 Board of Directors. He currently sits in 10 boards including private equity funds, microfinance funds, fintech funds, financial institutions and one NGO where he is chairman of the board in 4 of those. One of those highlighted is his Chairmanship of CIFI .

Since 2006 he is the Regional Director for Norfund in Latin America, heading a team who has invested and manages a portfolio in the above-mentioned sectors.

He has a master’s degree in Economics of Money Banking and Finance from the University of Shefield in the UK. He also has two bachelor’s degrees from the University Texas at Austin. One in Business Administration with focus in Finance, and the second in Economics.

Javier Escorriola

VALORA

He has extensive experience in the banking and financial sector. He has worked at Norfund for 9 years leading debt and equity transactions in the region. He currently works as regional director for the company for Latin America. Norfund is the Norwegian Investment Fund for developing countries, whose mission is to create jobs and improve lives by investing in companies that drive sustainable development. Norfund is owned and funded by the Norwegian Government and is the Government's most important instrument for strengthening the private sector in developing countries and reducing poverty.

In the banking area, he served as Regional Manager in capital markets and corporate banking for RBTT Merchant Bank and was Finance Manager for Banco Improsa in Costa Rica.

Federico Fernández Woodbridge

NORFUND

Alison was Global Head of Capital Markets at the World Bank Group where she oversaw an international portfolio of advisory operations to build local markets to finance development. Earlier, Alison was Director of the Capital Markets Practice at the Barents Group LLC and Resident Advisor on financial sector reform with Harvard’s Institute for International Development in Indonesia. She began her career at the Federal Reserve Bank of New York.

Alison has published and is a frequent speaker on emerging markets and sustainable finance. She is on the board of CIFI, on the Securities Markets Advisory Board and program leader on sustainable and green finance at the Toronto Centre, and on the Kenyan CMA’s advisory panel. She has an M.B.A. and master’s in international Affairs from Columbia University.

Alison Harwood

Independent Member

CIFI S.A. and Restoque S.A., one of the main fashion retailers in Brazil and listed in the São Paulo stock exchange (B3).

Until early 2020 he was the CEO of CaixaBI, one of the main investment banks in Portugal and a subsidiary of CGD Group, the State-owned banking group.

Previously he was a senior executive for Portugal Telecom Group in Brazil, as M&A and Business Development Director at Vivo and as the CFO and EVP of Primesys. After that he moved to London to join Dynamo Capital as a Senior Investment Analyst and Partner until 2009, when he leaves to co-found and manage an emerging market focused hedge fund.

In 2012 he joins Caixa - Banco de Investimento, S.A., one of the main investment banks in Portugal, as a member of the Executive Team and is promoted to the CEO position in 2013.

Mr. Saldanha e Souza holds a degree in Economics and Finance from Nova School of Business and Economics (1993) and an MBA from University of Virginia Darden School of Business (1999).

Joaquim Souza

Independent Member

Audit

Committee

CIFI S.A. and Restoque S.A., one of the main fashion retailers in Brazil and listed in the São Paulo stock exchange (B3).

Until early 2020 he was the CEO of CaixaBI, one of the main investment banks in Portugal and a subsidiary of CGD Group, the State-owned banking group.

Previously he was a senior executive for Portugal Telecom Group in Brazil, as M&A and Business Development Director at Vivo and as the CFO and EVP of Primesys. After that he moved to London to join Dynamo Capital as a Senior Investment Analyst and Partner until 2009, when he leaves to co-found and manage an emerging market focused hedge fund.

In 2012 he joins Caixa - Banco de Investimento, S.A., one of the main investment banks in Portugal, as a member of the Executive Team and is promoted to the CEO position in 2013.

Mr. Saldanha e Souza holds a degree in Economics and Finance from Nova School of Business and Economics (1993) and an MBA from University of Virginia Darden School of Business (1999).

Joaquim Souza

Audit Committee Chair

Judith holds an M.B.A. from Harvard Business School and a B.A. in Economics from Wellesley College. Fluent in English, Spanish, Portuguese, French, and Hungarian, she is a dual Venezuelan/Hungarian national. She is also on the Board of Directors of Agua Imara; a Norwegian renewable energy company focused on hydropower in Africa and Central America.

Judith de Barany

Independent Member

He has extensive experience in the banking and financial sector. He has worked at Norfund for 9 years leading debt and equity transactions in the region. He currently works as regional director for the company for Latin America. Norfund is the Norwegian Investment Fund for developing countries, whose mission is to create jobs and improve lives by investing in companies that drive sustainable development. Norfund is owned and funded by the Norwegian Government and is the Government's most important instrument for strengthening the private sector in developing countries and reducing poverty.

In the banking area, he served as Regional Manager in capital markets and corporate banking for RBTT Merchant Bank and was Finance Manager for Banco Improsa in Costa Rica.

Since 2006 he is the Regional Director for Norfund in Latin America, heading a team who has invested and manages a portfolio in the above-mentioned sectors.

He has a master’s degree in Economics of Money Banking and Finance from the University of Shefield in the UK. He also has two bachelor’s degrees from the University Texas at Austin. One in Business Administration with focus in Finance, and the second in Economics.

Federico Fernández Woodbridge

NORFUND

In 1975 Terry was awarded an MBA in Finance and International Business from The University of Western Ontario, Canada. Terry is also a Fellow of the Institute of Canadian Bankers and a graduate (Honours) of the Canadian Securities Course.

He joined The Bank of Nova Scotia in June 1975 and spent 34 years with Scotiabank in junior middle and senior management positions in various countries including Canada, Hong Kong, The Philippines, Jamaica, Netherland Antilles and Panama. Departments included International Audit, Credit Adjudication, Ship Finance, Syndicated Loans, Commercial and Retail Banking and General Management. His last position was as V.P. and General Manager of Scotiabank Panama.

After retirement from Scotiabank he served for 5 years on the Board of the International School of Panama and was President. From 2013-2018 he served on the Board and several Committees, Including Audit, of Unibank S.A. a local Panamanian bank. Aside from CIFI Audit Committee he serves as Country Manager for Panama for The Laureola Fund, a Bermuda based Fund focused on investing in Life Settlements.

Terry McCoy

Independent Member

Carlos is a professional highly oriented towards control, compliance and quality assurance, with more than 30 years of experience in different Latin American countries, in areas such as external and internal audit, including regulatory compliance and risk management in multinational banking, pension investment funds and corporate finance. Additionally, he has held financial management positions in mass transportation companies and regional comptroller positions in higher education institutions in Central America.

He holds a degree in Public Accounting from Universidad Central de Colombia, a specialization in Financial Law from Universidad de Los Andes in Colombia, as well as a diploma in International Financial Reporting Standards from Universidad UNESCPA. He has an ISO 9000 internal quality auditor certification and training in accounting and technical aspects of financial derivatives.

He joined CIFI in 2018 as Corporate Compliance Officer, assuming Internal Audit in 2020.

Carlos Poveda

Internal Auditor

Compensation

Committee

Alison was Global Head of Capital Markets at the World Bank Group where she oversaw an international portfolio of advisory operations to build local markets to finance development. Earlier, Alison was Director of the Capital Markets Practice at the Barents Group LLC and Resident Advisor on financial sector reform with Harvard’s Institute for International Development in Indonesia. She began her career at the Federal Reserve Bank of New York.

Alison has published and is a frequent speaker on emerging markets and sustainable finance. She is on the board of CIFI, on the Securities Markets Advisory Board and program leader on sustainable and green finance at the Toronto Centre, and on the Kenyan CMA’s advisory panel. She has an M.B.A. and master’s in international Affairs from Columbia University.

Alison Harwood

Compensation Committee Chair

Judith holds an M.B.A. from Harvard Business School and a B.A. in Economics from Wellesley College. Fluent in English, Spanish, Portuguese, French, and Hungarian, she is a dual Venezuelan/Hungarian national. She is also on the Board of Directors of Agua Imara; a Norwegian renewable energy company focused on hydropower in Africa and Central America.

Judith de Barany

Independent Member

CIFI S.A. and Restoque S.A., one of the main fashion retailers in Brazil and listed in the São Paulo stock exchange (B3).

Until early 2020 he was the CEO of CaixaBI, one of the main investment banks in Portugal and a subsidiary of CGD Group, the State-owned banking group.

Previously he was a senior executive for Portugal Telecom Group in Brazil, as M&A and Business Development Director at Vivo and as the CFO and EVP of Primesys. After that he moved to London to join Dynamo Capital as a Senior Investment Analyst and Partner until 2009, when he leaves to co-found and manage an emerging market focused hedge fund.

In 2012 he joins Caixa - Banco de Investimento, S.A., one of the main investment banks in Portugal, as a member of the Executive Team and is promoted to the CEO position in 2013.

Mr. Saldanha e Souza holds a degree in Economics and Finance from Nova School of Business and Economics (1993) and an MBA from University of Virginia Darden School of Business (1999).

Joaquim Souza

Independent Member

Credit

Committee

In this position he has led the growth and expansion of the company, as well as the constant development of its management team and all associates.

He is a business visionary who has made CIFI a leading player in the financing of infrastructure projects with sustainable impact in the region, as well as a relevant player in the capital market.

Within CIFI, César has been Director of Business Development and Director of the Structured and Project Financing team. As CIFI's helmsman, César has led the company to significant successes.

Managed to stabilize annual business volume in financial advisory services at 7 million US dollars. It also led it to increase its assets under management (including loan portfolio and funds) to US$600 million.

During its leadership CIFI has achieved the diversification of financing sources until it became a bond issuer in Panama, El Salvador, Honduras, Costa Rica and Colombia.

Under the management of Cañedo-Argüelles, CIFI also launched new products in the region. For example, the creation of the fund management branch, through the subsidiary CIFI Asset Management, achieving the first fund in local currency in the Dominican Republic equivalent to US$ 280 million, additionally the creation of a securitization program of US $100 million with the Pension Funds in El Salvador.

It is currently in the process of raising a sustainable infrastructure fund of US$300 million and a local currency fund in Brazil equivalent to US$100 million.

It should be noted that during the last 4 years the company has given a stable return to the shareholder above 8%.

Before joining the foundation of CIFI, César was already developing professionally in the financial, infrastructure and investment banking sectors. He was CFO (1999-2001) and Director of International Business Development (1994-1999) at PROINTEC, an infrastructure engineering and consulting company. There he left his mark on the development of a dozen successful projects throughout Latin America, Asia and Africa. He was passionate about implementing and managing large energy, transportation, telecommunications, water and capacity development projects. had the vision of bringing the financing of similar structures and projects to the middle market in Latin America and the Caribbean.

César Cañedo-Argüelles

CEO and Credit Committee Chair

He is a member of the Pipeline, ALCO and Credit Committees, and secretary of the CIFI Risk Committee.

Fabio is a decisive, action-oriented and results-driven senior executive with over 25 years of experience in multi-diverse environments, including banking, infrastructure, energy and manufacturing industries.

He is a team leader with a proven ability to effectively achieve objectives through sound management, effective leadership and analytical skills, with proven success in mitigating risks in companies with leverage issues in Latin America.

He holds a PhD in Statistics and a Master's degree in Operations Research and Infrastructure Management from Rensselaer Polytechnic Institute, and a Bachelor's degree in Civil Engineering from Universidad de los Andes (Colombia).

He is certified as a Financial Risk Manager (FRM) by the Global Association of Risk Professionals (GARP), and as a PMP by the Project Management Institute. He was also a member of the Risk Committee at the Panama Banking Association (2012-2015), where the Committee oversaw the analysis, discussion and negotiation of the new Agreement No. 4-2013, which established all regulation related to credit risk management, from origination to credit reserves and credit risk models, following Basel II.

Joined CIFI in 2016 and became a shareholder of Valora in 2019.

Fabio Arciniegas

Chief Operating Officer

He is a member CIFI’s founding team, since 2002 when he joined the company as Legal Advisor. He became General Counsel in 2012, where he is responsible for directing all legal affairs of the company and managing its legal department.

During his tenure at CIFI he has led and overseen the structuring, negotiation, closing and monitoring of more than $1.5 billion worth of assets, all its liabilities in both the syndicated loan and capitals markets, while leading CIFI’s corporate and regulatory matters (including advising on audit, budgeting, compliance, employment, governance, investor presentation, litigation, securities and tax planning matters). Since January 2021, he is a member of its Credit Committee. Prior to joining CIFI, between 1996 and 2001, he was an Associate at Torres, Plaz & Araujo, a well-known corporate and tax law firm in Caracas, Venezuela, where he advised multinational corporations doing business in the country. In 1998 he was seconded as in-house legal counsel to EPIC, Exploración & Producción, Entidad de Inversión Colectiva, an affiliate of PDVSA, to lead its legal department in the initial public offering of shares valued at $450 million in the capital market in Venezuela and New York (then the largest IPO in Venezuela).

He holds a Master of Business Administration (2003) from Kogod School of Business, American University, Washington, DC.; a Master in International Commercial Law (LL.M) (1995) from the George Washington University, School of Law, Washington, DC.; and a Juris Doctor (1992) from Universidad Central de Venezuela, School of Law, Caracas, Venezuela.

Jose Salaverria

General Counsel

Previously, he was the Vice-President and Director of the Investment Risk area in Legg Mason Asset Management. Mr. Moreno worked for us for ten years and was our former Chief Risk Officer, responsible for the development of and compliance with our risk management policy and risk tolerance levels, including environmental and social risks.

He is a licensed Professional Risk Manager from PRMIA. Mr. Moreno has a Master of Science in Finance from the George Washington University and a Financial Engineer title from Columbia University, NY.

Juan Pablo Moreno

Independent Member

She is currently the Head of M&A Renewables for Spain’s Cepsa and is supporting the company in its energy transition. Prior to that she was a Senior Advisor for Sonnedix, a global solar power producer and she also served as Managing Director and for the financial advisory firm Rubicon Capital Advisors.

Previous functions include Managing Director and Head of Infrastructure Investments in Latin America for the Caisse de dépôt et placement du Québec (CDPQ) in Montreal. Under such role, she was responsible for defining the investment strategy and the deployment of capital in infrastructure in Latin America for Canada’s second largest pension fund manager.

She also served under different roles at the Inter-American Development Bank (IDB) and at CAF Latin American Development Bank, where she led the origination and structuring of infrastructure project financings across Latin America.

Ms. Vidaurre is a multicultural professional, with residences and education in Venezuela, France, the U.S., Canada and Spain. She is fluent in Spanish, English, French, and proficient in Portuguese. She has several boards, including Mexico’s Conmex road and Kino renewable energy holdings in Mexico.

Ana Maria holds a Bachelor’s of Business Administration from Universidad Metropolitana in Caracas, Venezuela, and an MBA from ESSEC Business School in Paris, France.

Ana Maria Vidaurre

Independent Member

Risk

Committee

Eivind Hildre

Risk Committee Chair

During this tenure Javier has been member in over 40 Board of Directors. He currently sits in 10 boards including private equity funds, microfinance funds, fintech funds, financial institutions and one NGO where he is chairman of the board in 4 of those. One of those highlighted is his Chairmanship of CIFI .

Since 2006 he is the Regional Director for Norfund in Latin America, heading a team who has invested and manages a portfolio in the above-mentioned sectors.

He has a master’s degree in Economics of Money Banking and Finance from the University of Shefield in the UK. He also has two bachelor’s degrees from the University Texas at Austin. One in Business Administration with focus in Finance, and the second in Economics.

Javier Escorriola

VALORA

Throughout her career, Helena has held different roles at the Finnish Fund for Industrial Cooperation (Finnfund), a Finnish development financier and impact investor, where she is currently Associate Director and Senior Investment Manager of the power team.

Helena has been part of boards and investment committees for the last 20 years. She has made significant contributions to renewable energy projects worldwide, including in Africa, Asia or Central America. She is currently a Board Member at Fortum Charge & Drive India Pvt Ltd and Lake Turkana Wind Power Ltd. (Kenya). She also sits on the Investment Committees of ElectriFi and Interact Climate Change Facility, both part of the European Development Finance Institutions.

Helena Teppana

FINNFUND

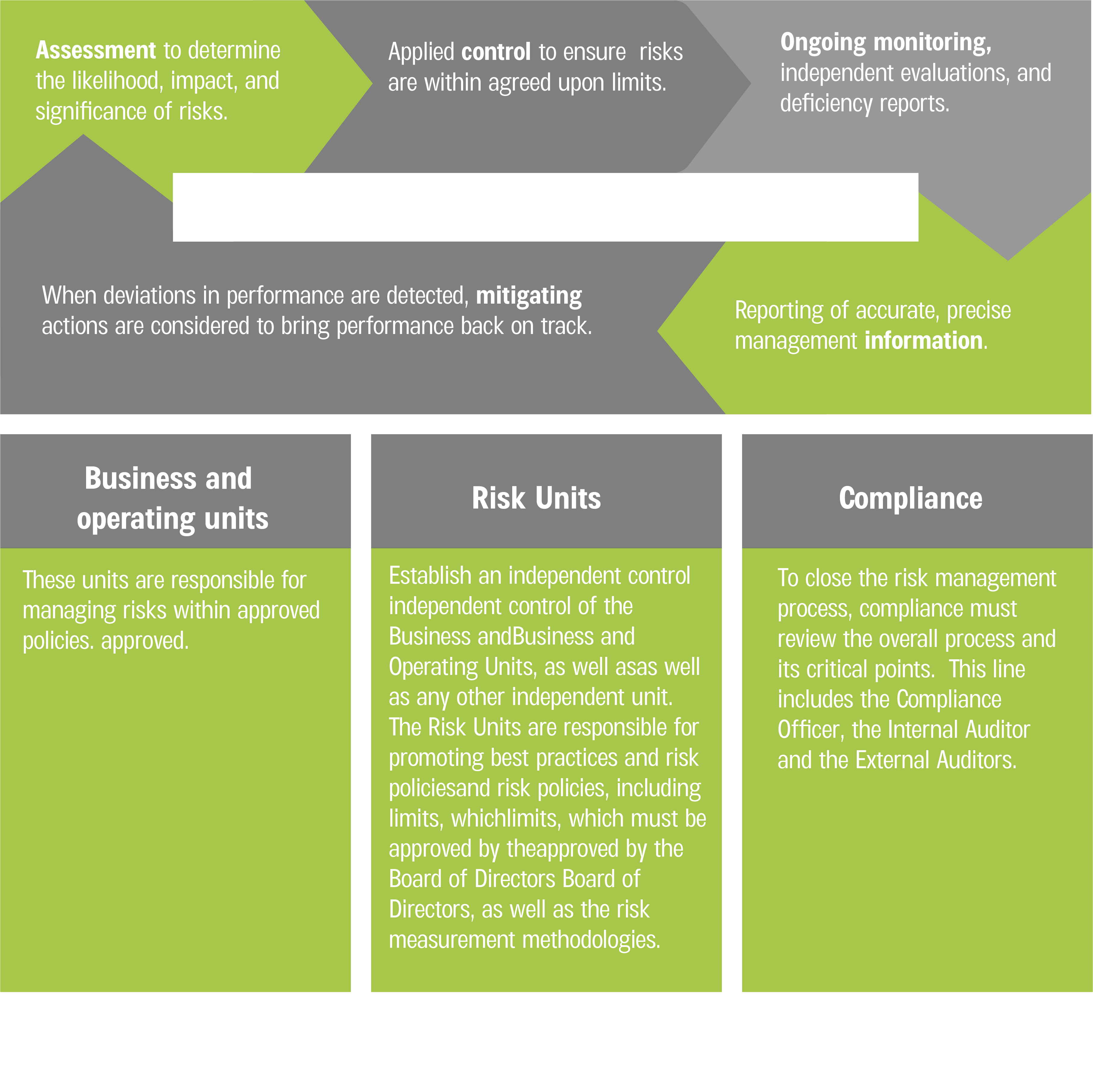

Risk Management

Risk Management Process

The main objective of CIFI´s ERM is to achieve a coherent regulatory framework aligned with our business model that fosters a business risk culture inherent in all areas and influences proactive involvement when facing risks, so all areas may identify, measure, monitor, control, and report all the risks to which they are exposed.

Indentifying is a key component of CIFI’s ERM, which includes early identifying techniques and a well-defined risk appetite and tolerance to identify the risks the company faces.

Risk Management Process

The main objective of CIFI´s ERM is to achieve a coherent regulatory framework aligned with our business model that fosters a business risk culture inherent in all areas and influences proactive involvement when facing risks, so all areas may identify, measure, monitor, control, and report all the risks to which they are exposed.

Indentifying is a key component of CIFI’s ERM, which includes early identifying techniques and a well-defined risk appetite and tolerance to identify the risks the company faces.

Management Team

In this position he has led the growth and expansion of the company, as well as the constant development of its management team and all associates.

He is a business visionary who has made CIFI a leading player in the financing of infrastructure projects with sustainable impact in the region, as well as a relevant player in the capital market.

Within CIFI, César has been Director of Business Development and Director of the Structured and Project Financing team. As CIFI's helmsman, César has led the company to significant successes.

Managed to stabilize annual business volume in financial advisory services at 7 million US dollars. It also led it to increase its assets under management (including loan portfolio and funds) to US$600 million.

During its leadership CIFI has achieved the diversification of financing sources until it became a bond issuer in Panama, El Salvador, Honduras, Costa Rica and Colombia.

Under the management of Cañedo-Argüelles, CIFI also launched new products in the region. For example, the creation of the fund management branch, through the subsidiary CIFI Asset Management, achieving the first fund in local currency in the Dominican Republic equivalent to US$ 280 million, additionally the creation of a securitization program of US $100 million with the Pension Funds in El Salvador.

It is currently in the process of raising a sustainable infrastructure fund of US$300 million and a local currency fund in Brazil equivalent to US$100 million.

It should be noted that during the last 4 years the company has given a stable return to the shareholder above 8%.

Before joining the foundation of CIFI, César was already developing professionally in the financial, infrastructure and investment banking sectors. He was CFO (1999-2001) and Director of International Business Development (1994-1999) at PROINTEC, an infrastructure engineering and consulting company. There he left his mark on the development of a dozen successful projects throughout Latin America, Asia and Africa. He was passionate about implementing and managing large energy, transportation, telecommunications, water and capacity development projects. had the vision of bringing the financing of similar structures and projects to the middle market in Latin America and the Caribbean.

César Cañedo-Argüelles

Chief Executive Officer

He has represented his employers as a board member in several companies. In 2003 he earned an MBA in Finance from Purdue University. And set out to advance professionally with exposure to various industries, he is fluent in English, Spanish, German and has a basic level of Portuguese, skills that have allowed him to thrive in the industry internationally.

Ramón Candia

Chief Investment Officer

She has 18 years of experience in scientific research, applied sciences for global problems, sustainable development, clean energy, climate change, green lending, and impact investment. Prior to CIFI, Carla worked extensively in Latin America and the Caribbean with scientific research organizations (Smithsonian), the academia (Yale University), and multilateral organizations (United Nations).

At CIFI, oversees managing E&S risks and impacts prior to investments, supervises ESG performance of the portfolio, compliance with CIFI’s policy framework, stakeholder engagement, identification of green business opportunities and funding, development of tools, and reporting with transparency. Carla is currently developing a Decarbonization Strategy to align CIFI’s investment portfolio to a 1.5°C economy, is responsible for the Gender Equality Strategy of the company, and commitments towards Human Rights in all our investments.

She was part of the team that issued the first Green Bond Programme in Panama for $200MM, designed of an ESG Software, a Key Risk Indicator, and a Scoring System to manage ESG risks. Carla is an Equator Principles Association Steering Committee member, and Lead of the Regional Network for Latin America.

She has strong technical expertise, is results oriented, has great networking skills, creative-analytical thinking, outstanding organizational and communication skills, is proactive, and an excellent researcher with knowledge management. She is fluent in Spanish, English and proficient in Portuguese.

She has been with CIFI since 2016, joined the management team of the company in 2018, and became a shareholder in Valora in 2019.

Carla Chízmar

Head of Environmental, Social, and Governance

He is a member CIFI’s founding team, since 2002 when he joined the company as Legal Advisor. He became General Counsel in 2012, where he is responsible for directing all legal affairs of the company and managing its legal department.

During his tenure at CIFI he has led and overseen the structuring, negotiation, closing and monitoring of more than $1.5 billion worth of assets, all its liabilities in both the syndicated loan and capitals markets, while leading CIFI’s corporate and regulatory matters (including advising on audit, budgeting, compliance, employment, governance, investor presentation, litigation, securities and tax planning matters). Since January 2021, he is a member of its Credit Committee. Prior to joining CIFI, between 1996 and 2001, he was an Associate at Torres, Plaz & Araujo, a well-known corporate and tax law firm in Caracas, Venezuela, where he advised multinational corporations doing business in the country. In 1998 he was seconded as in-house legal counsel to EPIC, Exploración & Producción, Entidad de Inversión Colectiva, an affiliate of PDVSA, to lead its legal department in the initial public offering of shares valued at $450 million in the capital market in Venezuela and New York (then the largest IPO in Venezuela).

He holds a Master of Business Administration (2003) from Kogod School of Business, American University, Washington, DC.; a Master in International Commercial Law (LL.M) (1995) from the George Washington University, School of Law, Washington, DC.; and a Juris Doctor (1992) from Universidad Central de Venezuela, School of Law, Caracas, Venezuela.

Jose Salaverria

General Counsel

He is a member of the Pipeline, ALCO and Credit Committees, and secretary of the CIFI Risk Committee.

Fabio is a decisive, action-oriented and results-driven senior executive with over 25 years of experience in multi-diverse environments, including banking, infrastructure, energy and manufacturing industries.

He is a team leader with a proven ability to effectively achieve objectives through sound management, effective leadership and analytical skills, with proven success in mitigating risks in companies with leverage issues in Latin America.

He holds a PhD in Statistics and a Master's degree in Operations Research and Infrastructure Management from Rensselaer Polytechnic Institute, and a Bachelor's degree in Civil Engineering from Universidad de los Andes (Colombia).

He is certified as a Financial Risk Manager (FRM) by the Global Association of Risk Professionals (GARP), and as a PMP by the Project Management Institute. He was also a member of the Risk Committee at the Panama Banking Association (2012-2015), where the Committee oversaw the analysis, discussion and negotiation of the new Agreement No. 4-2013, which established all regulation related to credit risk management, from origination to credit reserves and credit risk models, following Basel II.

Joined CIFI in 2016 and became a shareholder of Valora in 2019.

Fabio Arciniegas

Chief Operating Officer