Information

for Investors

Potential Investors

For more information contact

our investment advisors HERE

CIFI, as a leading private sector infrastructure project financier in Latin America and the Caribbean,

is characterized by a highly diversified debt platform by country and sector, and through its fundraising strategy is the bridge between institutional investors, development institutions and commercial banks with the infrastructure sector in the region.

In addition to its proven track record, CIFI has a structure of Corporate Governance and institutional transparency of the highest level, thus providing its investments and creditors, reliability in its financial figures, policy monitoring and disclosure of information.

Financial Perfomance:

(Year 2023, figures in USD millions and percentages)

359

Loan Portfolio

434

Total Assets

113

Equity

13.74%

Capital adequacy index

9.8

Net Income

9%

ROE

47%

Operating efficiency

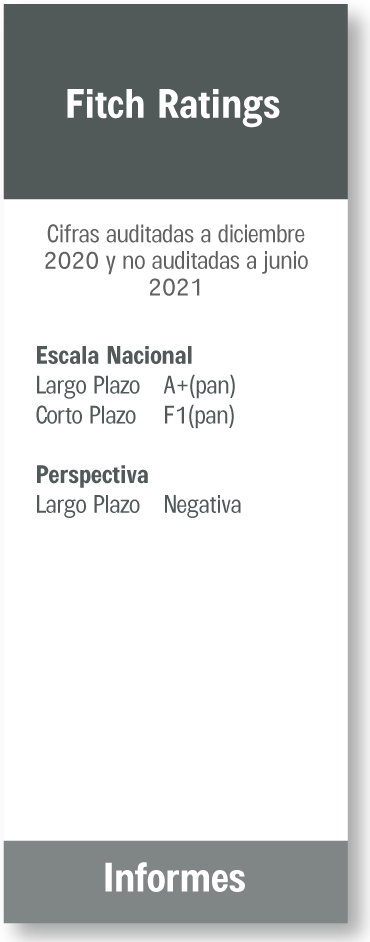

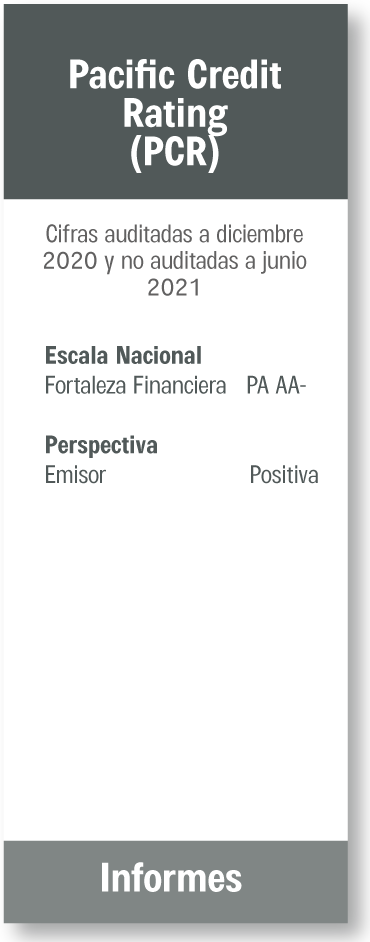

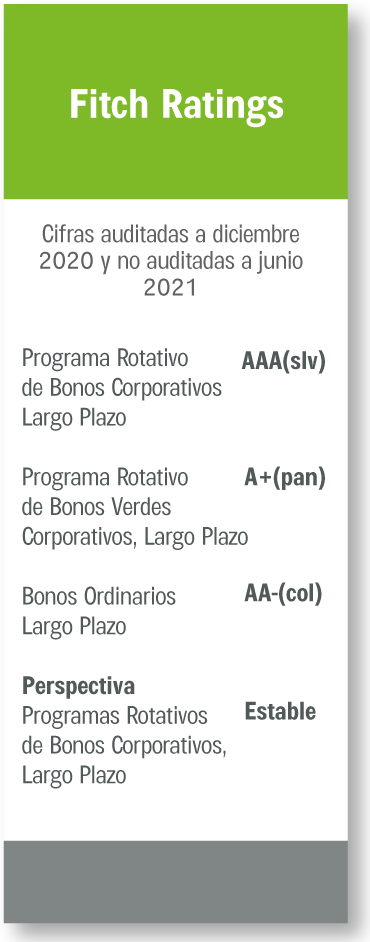

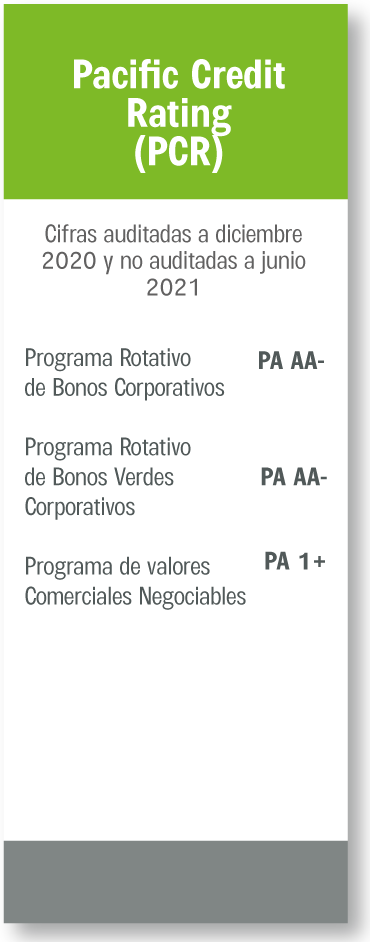

Credit Ratings

CIFI maintains both short- and long-term credit ratings at the entity level, in addition to the ratings of its issuance programs.

The ratings incorporate good initiatives to control its exposures in countries where economies are more vulnerable; stable historical profitability; adequate capitalization levels; and diversified funding sources to drive portfolio growth and promote a high capacity to pay its obligations.

Issuer´s Rating

Issuance Programs Rating

Calificación de Emisor

Calificación de Los Programas

de Emisión

Capital Markets

Issuance

CIFI’s financial strategy allows it to diversify its funding structure through different instruments and programs. CIFI’s active participation in the region’s capital markets reflects its good credit profile and the investor interest in participating in a diversified funding platform throughout the region.

Negotiable Commercial Paper Program (VCN's)

Revolving Corporate Bond Program

Revolving Green Bond Program

CIFI also has a Green Bonds program, debt instruments issued exclusively to finance eligible green projects in sectors such as renewable energy and waste management.

CIFI’s presence in other markets:

Issuance of Ordinary Bonds in Colombia

Thematic Bonds

Sustainable Investment

Opportunities

CIFI offers a platform for investors interested in infrastructure assets that contribute to solving social and environmental problems.

Green Bond Program

Relevant information

At CIFI we are committed to timely and reliable delivery of financial information to all stakeholders. Read more

Securitization of

infrastructure assets

Fondos

República Dominicana

Lorem ipsum dolor sit amet, consectetuer adipiscing elit, sed diam nonummy nibh euismod tincidunt ut laoreet dolore magna aliquam erat volutpat. Ut wisi enim ad minim veniam, quis nostrud exerci tation ullamcorper suscipit lobortis nisl ut aliquip ex ea commodo consequat.

Contact our team

She previously served as Treasury and Finance Team Leader at Celsia Central America and Engie. She was Treasury Officer at BNP Paribas Panama Branch and Global Bank Corporation.

She holds a Bachelor's Degree in Finance from Universidad Católica Santa María La Antigüa, Magna Cum Laude. A Postgraduate and a master’s degree in Economics for the Formulation, Evaluation and Administration of Projects from the University of Panama. And a Postgraduate Degree in Financial Markets from Universidad Católica Santa María La Antigüa.

Neila Urriola

Treasury Director