Our Vision is to champion and deliver transformational, long-term, positive impact for our clients, employees, investors, society and the environment, whilst providing sustainable returns globally.

Our Vision is to champion and deliver transformational, long-term, positive impact for our clients, employees, investors, society and the environment, whilst providing sustainable returns globally.

Our

Commitment

to Sustainability

Over the years, CIFI’s commitment to sustainability has grown significantly over the years to become part of our business model, increasingly demanding a holistic approach that we hope our stakeholders will value as much as we do.

Throughout every project, we focus on relevant environmental, social, and governance aspects to thoroughly manage risks, ensuring sustainable development from our financing, and creating a positive impact in a critical world-wide momentum that demands transformational changes in the financial world.

Our

Commitment

to Sustainability

Over the years, CIFI’s commitment to sustainability has grown significantly over the years to become part of our business model, increasingly demanding a holistic approach that we hope our stakeholders will value as much as we do.

Throughout every project, we focus on relevant environmental, social, and governance aspects to thoroughly manage risks, ensuring sustainable development from our financing, and creating a positive impact in a critical world-wide momentum that demands transformational changes in the financial world.

Impact and Risk management encloses prevention, mitigation, and adaptation measures deploying our strong strategy to tackle impacts affecting climate change, poverty, equality, decent work, and economic and social growth. We also promote the best practices and technology to lead responsible financing that reduces waste and pollution, protects biodiversity, and encourages sustainable use of natural resources.

Consequently, the environmental and social global responsibility thrives us to promote equivalent accountability in our clients to respect and foster actions regarding our ESG Policies and Position Statements.

Read more

Impact and Risk management encloses prevention, mitigation, and adaptation measures deploying our strong strategy to tackle impacts affecting climate change, poverty, equality, decent work, and economic and social growth. We also promote the best practices and technology to lead responsible financing that reduces waste and pollution, protects biodiversity, and encourages sustainable use of natural resources.

Consequently, the environmental and social global responsibility thrives us to promote equivalent accountability in our clients to respect and foster actions regarding our ESG Policies and Position Statements.

Read more

Sustainability

in infrastructure

CIFI promotes projects that demonstrate financial viability but also consider environment and society, including the impact of Climate Change.

Our focus

Responsible Investment

& Positive Impact

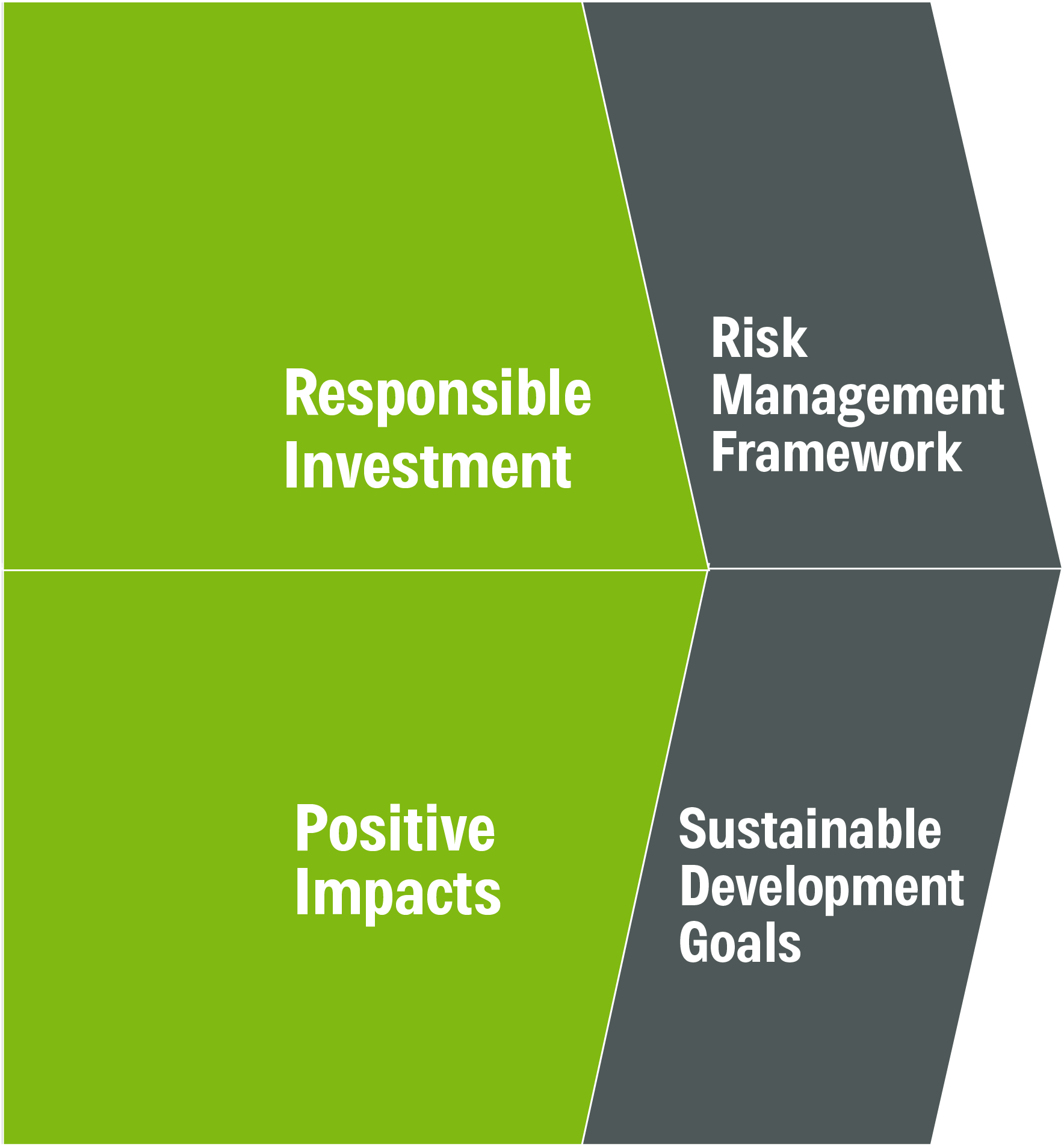

For us, responsible investment means mainstreaming ESG factors in the decision-making process of our entire operation.

Our business model has embedded an ESG risk management framework (ESMS) that allows us to identify, assess, and manage environmental, social risks and impacts associated with our finance projects.

Our commitment to sustainability goes beyond ESG Risk management, aiming to become a transformational agent of change fostering long-term positive impacts to all stakeholders.

Read more

Risk Management

Framework

Our Risk Management Framework imposes a comprehensive Environmental and Social Management System (ESMS), which policies and processes help us meet our commitment to sustainability consistently.