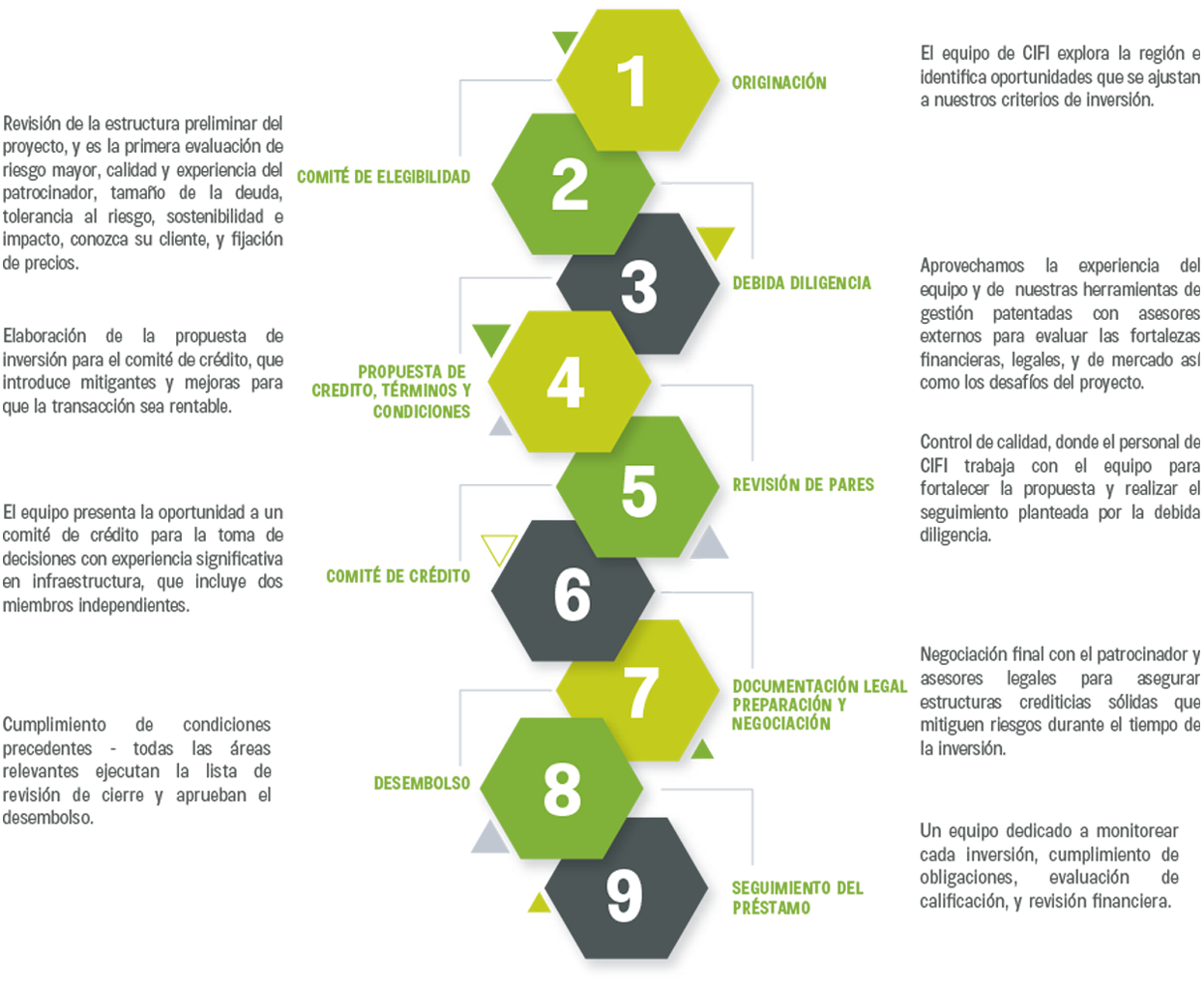

Review of the project´s preliminary structure, and it’s the first assessment of: major risk, quality and experience of the sponsor, debt sizing, risk appetite, ESG, KYC and pricing.

Review of the project´s preliminary structure, and it’s the first assessment of: major risk, quality and experience of the sponsor, debt sizing, risk appetite, ESG, KYC and pricing.

Prepare the investment proposal for the Credit committee, introducing mitigants and enhancements need to make the transaction bankable.

Deal Team presents the opportunity to a decision-making credit committee with significant experience in Infrastructure, which include two independent members.

Fulfillment of conditions precedent, all the relevant areas execute the closing checklist, and signoff on the disbursement.

CIFI´s team scout the region and identify opportunities that fit our investment criteria.

Leverage the experience of the Team, our proprietary management tools with External advisors to evaluate the finance, Technical Legal and Market strengths and challenges of the project.

Quality control step, where CIFI´s staff works together with the Deal Team to strengthen the proposal and follow up issued raised by the due diligence.

Final negotiation with the Sponsor, Legal Advisors to ensure strong credit structures which mitigate risks during the life of the investment.

Team dedicated to monitor each investment, covenant compliance, rating assessment and financial review.