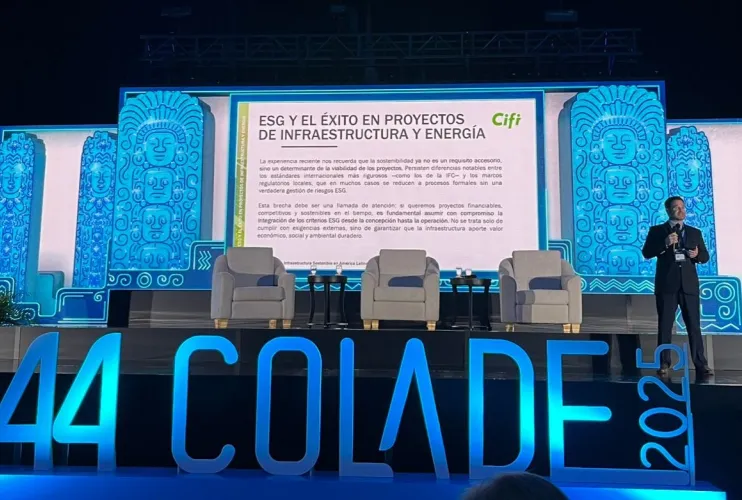

As part of the 44th Latin American Congress of Financial Law (COLADE), organized by the Latin American Federation of Banks (FELABAN), a forum that for over four decades has brought together the region’s leading experts in financial and regulatory law, José H. Salaverría, Legal Director of CIFI, delivered a presentation highlighting the challenges and opportunities in financing infrastructure and energy projects in Latin America and the Caribbean.

His presentation, both technical and strategic, emphasized CIFI’s crucial role as an institution capable of bridging international standards with the unique characteristics of regional markets, offering innovative solutions to attract capital and ensure bankability in complex environments.

Structural Gaps and Mitigation Mechanisms

The region faces an infrastructure investment gap estimated at $2.2 trillion by 2030, equivalent to 3% of the annual regional GDP. However, attracting that capital requires overcoming persistent obstacles: regulatory risk, lack of contractual standardization, deficiencies in feasibility studies, and credit weaknesses.

According to Salaverría, “Projects don’t fail solely due to lack of financing; often, it’s the absence of robust legal and contractual structures that undermines investor confidence.”

He highlighted the contrast between EPC (Engineering, Procurement and Construction) contracts used in developed markets, which guarantee fixed price and timeline backed by financial support, and the more fragmented structures common in the region. Tools such as trusts, automatic adjustment clauses, direct agreements with effective intervention rights, and strong sponsorship agreements have helped build investor confidence, enabling the closure of high-impact projects.

The Lawyer as Strategic Architect

A central theme of the presentation was the evolving role of the lawyer in project finance. It’s no longer just about reviewing contracts, the lawyer is now a strategic architect, tasked with translating investor vision into solid regulatory frameworks, coordinating all stakeholders, and shielding the project from regulatory changes typical of the region.

This perspective, shaped by over two decades of experience at CIFI, reinforces that legal foresight and disciplined structuring are essential conditions for achieving financial closure under sustainable terms.

“Each project is a lesson in itself. What matters is learning from experience and moving toward structures that blend local realities with global standards,” Salaverría emphasized.

Sustainability and Dual Jurisdiction

Sustainability is not an accessory, it’s a core element of bankability. Integrating environmental, social, and governance (ESG) metrics from the project’s inception increases investor confidence and ensures positive community impact. Ultimately, it’s about mitigating risks and enhancing business profitability.

The need for reliable jurisdictions and hybrid legal frameworks was also emphasized. Combining local laws with international jurisdictions like New York, supported by guarantees and autonomous promissory notes enforceable locally, is now essential for global financiers to take risks in emerging markets. Mechanisms such as blended finance, A/B loans, and MIGA guarantees are becoming key tools to attract institutional capital.

Tokenization and Future Vision

In line with the congress’s most disruptive discussions, COLADE 2025 addressed asset tokenization, a trend shifting from theory to real practice in Latin America. The ability to fractionalize infrastructure assets, from energy plants to road concessions, and represent them digitally on blockchain opens the door to democratized investment and broader, more transparent liquidity.

With on-chain records that streamline settlements and strengthen traceability, traditional markets are finding effective bridges to the digital world. In this context, CIFI’s expertise in legal and financial structuring becomes a strategic advantage for transforming sustainable projects into reliable tokenized investment vehicles.

“Only by working with coherence and sustainability can we close the gaps and generate lasting impact,” concluded CIFI’s Legal Director, affirming that the institution will continue to be a key player in bridging global capital, technology, and local needs.